introduction DWAC Stock

Digital World Acquisition Corp (DWAC Stock) has garnered significant attention in the financial markets, particularly among retail investors. As a particular purpose acquisition company (SPAC), DWAC’s primary focus is to merge with or acquire other businesses, a strategy that has intrigued many in the investing community. This article delves into everything you need to know about DWAC stock, from its origins to its potential future. It includes frequently asked questions to help you make an informed investment decision.

What is DWAC Stock?

Digital World Acquisition Corp is an SPAC, which means it was created solely to raise capital through an initial public offering (IPO) to eventually acquire or merge with an existing company. DWAC made headlines when it announced plans to merge with Trump Media & Technology Group (TMTG), the company behind the social media platform TRUTH Social.

History and Background

DWAC was incorporated in December 2020 and went public in September 2021, raising $287.5 million in its IPO. The company’s stock is listed on the NASDAQ under the “DWAC.” The announcement of its merger with TMTG significantly impacted its stock price, leading to a substantial increase in trading volume and investor interest.

Why DWAC Stock is Gaining Attention

Several factors contribute to the growing interest in DWAC stock:

- High-Profile Merger: The association with former President Donald Trump’s media venture has placed DWAC in the spotlight, drawing attention from both supporters and critics.

- Social Media Potential: TMTG’s TRUTH Social aims to compete with mainstream social media platforms by promoting free speech and reducing perceived censorship. This mission has resonated with a segment of users and investors.

- Market Trends: The rise of SPACs and the increasing popularity of alternative social media platforms create a favorable environment for DWAC’s growth.

Financial Performance

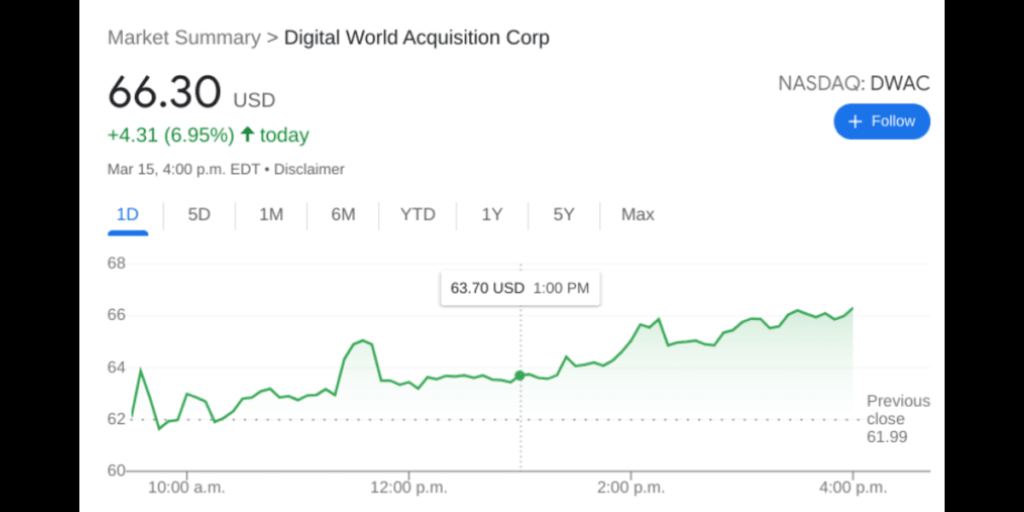

Stock Price Volatility

DWAC stock has experienced significant volatility since its IPO. The initial announcement of the merger with TMTG caused the stock to skyrocket, reaching all-time highs. However, like many SPACs, DWAC’s stock price has fluctuated considerably due to market conditions and investor sentiment.

Revenue Projections

As an SPAC, DWAC does not generate revenue independently. Its value hinges on the success of its mergers and acquisitions. Understanding the potential revenue and growth prospects of TMTG and TRUTH Social is crucial for investors to assess DWAC’s future performance.

Future Prospects

Merger Approval and Execution

The success of the merger between DWAC and TMTG is pivotal. Shareholders’ approval and the execution of the merger plan will significantly influence DWAC’s stock price. Investors should monitor regulatory filings and corporate announcements for updates.

Market Position and Competition

TRUTH Social aims to carve out a niche in the social media landscape. Competing with established giants like Facebook and Twitter and newer platforms will be challenging. However, if TRUTH Social can capture a dedicated user base, it could provide significant growth opportunities for DWAC.

Innovation and Expansion

Future innovations, user growth, and potential expansions into other media ventures will be critical for sustaining long-term investor interest. TMTG’s ability to adapt to market trends and user needs will directly impact DWAC’s stock performance.

Risks and Considerations

Regulatory Scrutiny

Both DWAC and TMTG are subject to regulatory scrutiny. Investors should be aware of potential legal and compliance issues affecting the merger and the companies.

Market Volatility

The stock market, particularly the SPAC sector, is known for volatility. DACs may experience significant price swings, which can be both an opportunity and a risk for investors.

Competitive Landscape

The social media industry is highly competitive. TRUTH Social’ ss will depend on its ability to differentiate itself and attract a substantial user base.

Frequently Asked Questions (FAQs)

What is DWAC Stock?

DWAC stock represents Digital World Acquisition Corp shares, a SPAC that aims to merge with or acquire other companies. It is listed on the NASDAQ under the ticker symbol “DWAC.””Why D”d DWAC Stock Surge?

DWAC stock surged primarily due to the announcement of its merger with Trump Media & Technology Group, which plans to launch the social media platform TRUTH Social.

Is DWAC a Good Investment?

Investing in DWAC Stock carries both potential rewards and risks. The stock’s performance will largely depend on the success of its merger with TMTG and the market reception of TRUTH Social. Investors should conduct thorough research and consider their risk tolerance before investing.

What Are the Risks Associated with DWAC Stock?

Key risks include regulatory scrutiny, market volatility, and the highly competitive nature of the social media industry. DWAC’s future success is closely tied to TRUTH Social’ Social’ sys ability to attract and retain users.

How Can I Buy DWAC Stock?

DWAC stock can be purchased through most brokerage accounts. Investors should consult their broker and consider the potential risks and rewards before purchasing.

What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is formed to raise capital through an IPO to acquire or merge with an existing company. SPACs allow private companies to go public without undergoing a traditional IPO process.

What is TRUTH Social?

TRUTH Social is a social media platform that Trump Media & Technology Group developed. It aims to promote free speech and provide an alternative to mainstream social media platforms.

Conclusion

DWAC stock has captured the attention of investors due to its high-profile merger with Trump Media & Technology Group and the potential of TRUTH Social. While the stock presents opportunities for significant gains, it also comes with inherent risks typical of SPAC investments. Investors should stay informed about merger developments, market trends, and regulatory issues to make well-informed investment decisions. As with any investment, careful consideration and due diligence are essential.